Monday, 02/02/2026 | 09:05 GMT by

Damian Chmiel

-

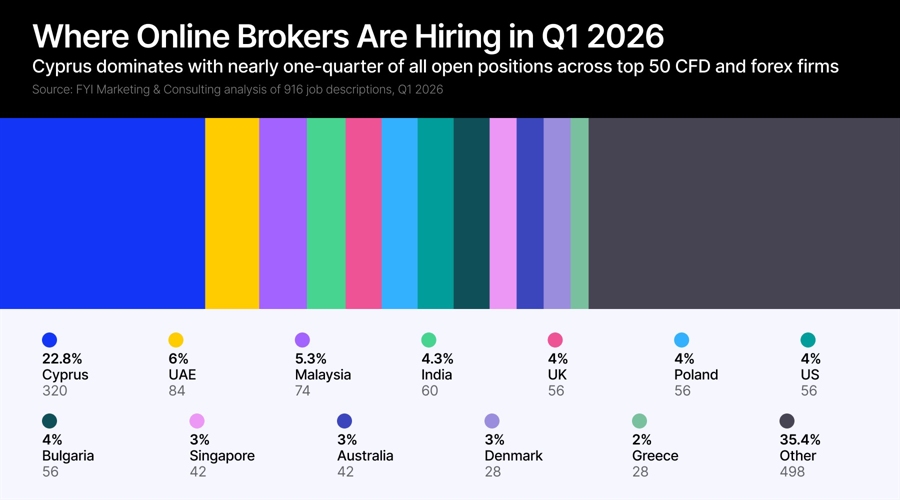

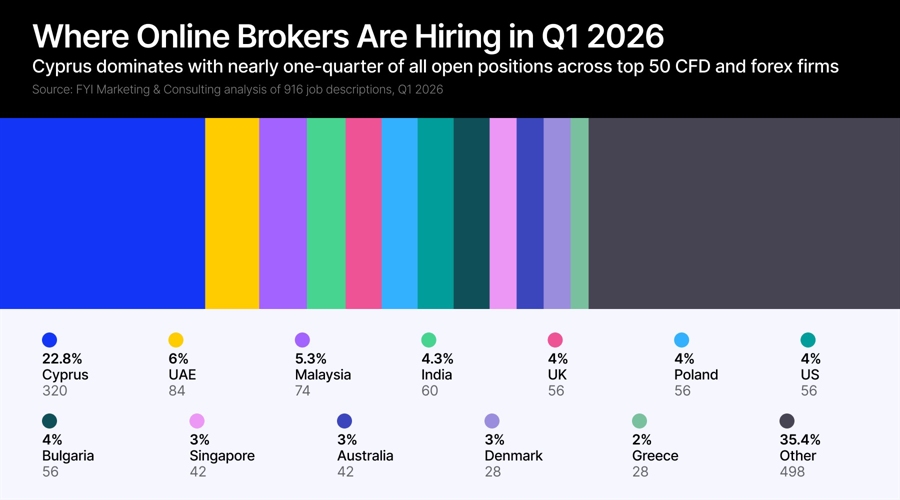

Cyprus accounts for virtually a quarter of all begin positions among the end 50 CFD and international change corporations, in step with sleek prognosis by FYI.

-

The engineering and enterprise pattern roles dominate hiring patterns, whereas remote work opportunities continue to claim no

The arena’s

50 finest online brokers are advertising extra than 1,400 begin positions

globally, with Cyprus capturing the lion’s fragment of hiring process at 22.8% of

all vacancies, in step with sleek files compiled by marketing consultancy FYI.

Christian Görgen, Marketing Consultant at FYI.LTD

“Most

begin positions are currently in Cyprus,” said Christian Görgen from

marketing company FYI, who analyzed nearly 1000 job descriptions across the sector.

“Followed by the UAE, Malaysia and India.”

Dubai Momentum Slows as

Cyprus Regains Ground

The information

challenges recent speculation

about Dubai displacing Cyprus because the enterprise’s predominant injurious.

“There

has been masses of debate unbiased no longer too long within the past around whether Cyprus is being replaced

by Dubai because the first hub for the FX enterprise,” Görgen said. “From a

buyer acquisition and order standpoint, that may maybe well presumably be going on at the

moment. All the device through 2025, many smartly-established brokers vastly elevated

headcount within the GCC put and built out strategic, order-oriented

roles.”

This pattern

became once also highlighted by FinanceMagnates.com, which analyzed how

many brokers are flocking to Dubai, pushed in piece by licensing approval

times that are up

to 33% faster.

Then again,

hiring patterns counsel the legend is exciting. “When having a behold

specifically at unusual hiring process in Q1 2026, the image shifts,”

Görgen explained. “Our files means that recruitment momentum in Dubai

has began to slack, whereas Cyprus has regained importance as a core hiring

location. Of the 1,432 begin vacancies analyzed, 22.8% are primarily primarily based mostly in Cyprus,

making it the single finest hub for begin roles within the within the meantime.”

“There

is no longer any longer a single dominant hub. As an different, diversified regions are taking over specialised

capabilities: from strategy and product to operations, enterprise pattern, and

native market execution,” Görgen commented for FinanceMagnates.com

IT Dominates as Brokers

Prioritize Skills Infrastructure

“IT remains the largest hiring area, accounting for 29% of all open positions globally,” Görgen added in his prognosis. “This is followed by Marketing, Support, Partnerships, and Sales vacancies.”

The

emphasis on technology hiring mirrors broader fintech

enterprise trends, where vacancies jumped 30% in 2025 as corporations doubled down on

infrastructure. Cyber security

and IT roles continue to scheme abilities with a pair of of the ideal earnings in

financial technology sectors.

The most

continuously posted job titles encompass utility engineer, enterprise pattern

supervisor, and compliance officer. Other excessive-seek files from positions encompass

partnerships managers, QA engineers, DevOps engineers, and buyer make stronger

specialists.

The information

shows enterprise pattern positions are gaining prominence. Görgen’s prognosis

came across that partner, enterprise pattern, and affiliate marketing roles expose

specifically solid seek files from across the sector.

Marketing

positions appear extra fragmented and specialised when when in contrast with

partnership-centered roles, that are inclined to be less masses of and extra

generalized in their requirements.

The hiring

push comes as marketing

chiefs within the retail procuring and selling enterprise final precise 1.5 years on common, creating constant seek files from for sleek

leadership.

Faraway Work Loses Ground

as Corporations Pull Workers Back

Most intriguing 12.3%

of marketed roles are completely remote, signaling a clear retreat from

pandemic-technology work arrangements. Hybrid positions memoir for 23% of openings,

whereas 12.7% specify on-predicament work. Greater than half of job postings beget no longer specify

work location.

“Most intriguing

12.3% of vacancies are marketed as completely remote,” Görgen notorious. Faraway

positions are most regularly supplied when particular language trip is required

and complex to source in predominant financial centers.

The shift

wait on to site of job-primarily primarily based mostly work marks a fundamental switch from submit-COVID insurance policies

that many monetary companies and products corporations at the beginning embraced.

HFM and JustMarkets Lead

Aggressive Expansion

Amongst

particular particular person corporations, Interactive Brokers tops the list with roughly 100 begin

positions, adopted by HFM with a same amount and XM with around 90

vacancies. Capital.com, Swissquote, JustMarkets, CMC Markets, Vantage, and IG

round out the end hiring corporations.

Two corporations

stand out for their aggressive hiring outdoors Europe. HFM currently lists

around 100 begin roles across all departments, with visitors files indicating

predominant operations in Indonesia, Japan, Malaysia, South Africa and Kenya.

JustMarkets

had 67 begin positions at the time of prognosis, with visitors patterns pointing

mainly to Malaysia and South Africa alongside diversified emerging markets. Then again,

LinkedIn files shows the company’s median employee tenure stands at precise 1.1 years,

raising questions about retention as it scales right this moment.

Skills Skills Reveal

Top rate as AI Stays Niche

Python,

Excel, and SQL emerge as maybe the most in-seek files from technical skills. Other continuously

talked about tools encompass AWS, Git, CRM systems, Microsoft Set of enterprise, Docker, and

Kubernetes. Trading platforms MetaTrader 4 and MetaTrader 5 also appear

on a frequent foundation in job requirements.

Despite

enterprise buzz around man made intelligence, simplest 56 job descriptions point out

AI-linked skills or duties. “For most brokers, AI peaceful appears

extra tackle a buzzword than a clearly outlined, staffed feature,” in accordance

to the prognosis.

Net whisper positioning roles hang largely disappeared from dealer hiring plans, with simplest seven web pages positioning-particular positions in your complete dataset.

“Pure SEO roles are disappearing,” he notorious. “There are only 7 SEO-related roles in the entire dataset. This may point to a shift toward broader content, GEO/AI, and reputation roles—or a stronger focus on business development instead.”

Wage Transparency

Stays Uncommon All over Business

Most intriguing 21 of

916 analyzed job descriptions encompass any wage range files.

Compensation negotiations remain largely interior most, with corporations preferring

case-by-case discussions over public disclosure.

Cyprus has

solidified its feature because the enterprise’s predominant employment heart, where

compliance and unbiased valid heads fabricate six-pick salaries ranging as much as €150,000 yearly.

Within the meantime, Dubai’s FX

sales heads tell vastly elevated compensation, roughly double what their Cyprus

counterparts fabricate

Medical

insurance appears in 237 job descriptions as maybe the most frequent profit, adopted

by efficiency bonuses in 194 postings and competitive wage mentions in 186.

Paid smash day and education budgets round out the end five advantages.

The

generous perks that once characterised international change enterprise employment hang largely

disappeared. Exness stands as a distinguished exception, offering company autos in

Cyprus and working its contain gymnasium facilities in Malaysia, where the company is

currently hiring a smartly being supervisor.

The arena’s

50 finest online brokers are advertising extra than 1,400 begin positions

globally, with Cyprus capturing the lion’s fragment of hiring process at 22.8% of

all vacancies, in step with sleek files compiled by marketing consultancy FYI.

Christian Görgen, Marketing Consultant at FYI.LTD

“Most

begin positions are currently in Cyprus,” said Christian Görgen from

marketing company FYI, who analyzed nearly 1000 job descriptions across the sector.

“Followed by the UAE, Malaysia and India.”

Dubai Momentum Slows as

Cyprus Regains Ground

The information

challenges recent speculation

about Dubai displacing Cyprus because the enterprise’s predominant injurious.

“There

has been masses of debate unbiased no longer too long within the past around whether Cyprus is being replaced

by Dubai because the first hub for the FX enterprise,” Görgen said. “From a

buyer acquisition and order standpoint, that may maybe well presumably be going on at the

moment. All the device through 2025, many smartly-established brokers vastly elevated

headcount within the GCC put and built out strategic, order-oriented

roles.”

This pattern

became once also highlighted by FinanceMagnates.com, which analyzed how

many brokers are flocking to Dubai, pushed in piece by licensing approval

times that are up

to 33% faster.

Then again,

hiring patterns counsel the legend is exciting. “When having a behold

specifically at unusual hiring process in Q1 2026, the image shifts,”

Görgen explained. “Our files means that recruitment momentum in Dubai

has began to slack, whereas Cyprus has regained importance as a core hiring

location. Of the 1,432 begin vacancies analyzed, 22.8% are primarily primarily based mostly in Cyprus,

making it the single finest hub for begin roles within the within the meantime.”

“There

is no longer any longer a single dominant hub. As an different, diversified regions are taking over specialised

capabilities: from strategy and product to operations, enterprise pattern, and

native market execution,” Görgen commented for FinanceMagnates.com

IT Dominates as Brokers

Prioritize Skills Infrastructure

“IT remains the largest hiring area, accounting for 29% of all open positions globally,” Görgen added in his prognosis. “This is followed by Marketing, Support, Partnerships, and Sales vacancies.”

The

emphasis on technology hiring mirrors broader fintech

enterprise trends, where vacancies jumped 30% in 2025 as corporations doubled down on

infrastructure. Cyber security

and IT roles continue to scheme abilities with a pair of of the ideal earnings in

financial technology sectors.

The most

continuously posted job titles encompass utility engineer, enterprise pattern

supervisor, and compliance officer. Other excessive-seek files from positions encompass

partnerships managers, QA engineers, DevOps engineers, and buyer make stronger

specialists.

The information

shows enterprise pattern positions are gaining prominence. Görgen’s prognosis

came across that partner, enterprise pattern, and affiliate marketing roles expose

specifically solid seek files from across the sector.

Marketing

positions appear extra fragmented and specialised when when in contrast with

partnership-centered roles, that are inclined to be less masses of and extra

generalized in their requirements.

The hiring

push comes as marketing

chiefs within the retail procuring and selling enterprise final precise 1.5 years on common, creating constant seek files from for sleek

leadership.

Faraway Work Loses Ground

as Corporations Pull Workers Back

Most intriguing 12.3%

of marketed roles are completely remote, signaling a clear retreat from

pandemic-technology work arrangements. Hybrid positions memoir for 23% of openings,

whereas 12.7% specify on-predicament work. Greater than half of job postings beget no longer specify

work location.

“Most intriguing

12.3% of vacancies are marketed as completely remote,” Görgen notorious. Faraway

positions are most regularly supplied when particular language trip is required

and complex to source in predominant financial centers.

The shift

wait on to site of job-primarily primarily based mostly work marks a fundamental switch from submit-COVID insurance policies

that many monetary companies and products corporations at the beginning embraced.

HFM and JustMarkets Lead

Aggressive Expansion

Amongst

particular particular person corporations, Interactive Brokers tops the list with roughly 100 begin

positions, adopted by HFM with a same amount and XM with around 90

vacancies. Capital.com, Swissquote, JustMarkets, CMC Markets, Vantage, and IG

round out the end hiring corporations.

Two corporations

stand out for their aggressive hiring outdoors Europe. HFM currently lists

around 100 begin roles across all departments, with visitors files indicating

predominant operations in Indonesia, Japan, Malaysia, South Africa and Kenya.

JustMarkets

had 67 begin positions at the time of prognosis, with visitors patterns pointing

mainly to Malaysia and South Africa alongside diversified emerging markets. Then again,

LinkedIn files shows the company’s median employee tenure stands at precise 1.1 years,

raising questions about retention as it scales right this moment.

Skills Skills Reveal

Top rate as AI Stays Niche

Python,

Excel, and SQL emerge as maybe the most in-seek files from technical skills. Other continuously

talked about tools encompass AWS, Git, CRM systems, Microsoft Set of enterprise, Docker, and

Kubernetes. Trading platforms MetaTrader 4 and MetaTrader 5 also appear

on a frequent foundation in job requirements.

Despite

enterprise buzz around man made intelligence, simplest 56 job descriptions point out

AI-linked skills or duties. “For most brokers, AI peaceful appears

extra tackle a buzzword than a clearly outlined, staffed feature,” in accordance

to the prognosis.

Net whisper positioning roles hang largely disappeared from dealer hiring plans, with simplest seven web pages positioning-particular positions in your complete dataset.

“Pure SEO roles are disappearing,” he notorious. “There are only 7 SEO-related roles in the entire dataset. This may point to a shift toward broader content, GEO/AI, and reputation roles—or a stronger focus on business development instead.”

Wage Transparency

Stays Uncommon All over Business

Most intriguing 21 of

916 analyzed job descriptions encompass any wage range files.

Compensation negotiations remain largely interior most, with corporations preferring

case-by-case discussions over public disclosure.

Cyprus has

solidified its feature because the enterprise’s predominant employment heart, where

compliance and unbiased valid heads fabricate six-pick salaries ranging as much as €150,000 yearly.

Within the meantime, Dubai’s FX

sales heads tell vastly elevated compensation, roughly double what their Cyprus

counterparts fabricate

Medical

insurance appears in 237 job descriptions as maybe the most frequent profit, adopted

by efficiency bonuses in 194 postings and competitive wage mentions in 186.

Paid smash day and education budgets round out the end five advantages.

The

generous perks that once characterised international change enterprise employment hang largely

disappeared. Exness stands as a distinguished exception, offering company autos in

Cyprus and working its contain gymnasium facilities in Malaysia, where the company is

currently hiring a smartly being supervisor.

Damian’s stir with financial markets began at the Cracow College of Economics, where he obtained his MA in finance and accounting. Beginning from the retail dealer standpoint, he collaborated with brokerage properties and financial portals in Poland as an self sustaining editor and whisper supervisor. His stir with Finance Magnates began in 2016, where he’s working as a enterprise intelligence analyst.

- 3216 Articles

-

100 Followers

Finance Magnates Day-to-day Update

Procure the total top financial news delivered straight to your inbox. Preserve educated, end forward.

Abet Reading

Extra from the Creator

-

TNS Buyout of BT Radianz Creates One in every of the Biggest Trading Networks Globally

TNS Buyout of BT Radianz Creates One in every of the Biggest Trading Networks Globally

TNS Buyout of BT Radianz Creates One in every of the Biggest Trading Networks Globally

TNS Buyout of BT Radianz Creates One in every of the Biggest Trading Networks Globally

TNS Buyout of BT Radianz Creates One in every of the Biggest Trading Networks Globally

TNS Buyout of BT Radianz Creates One in every of the Biggest Trading Networks Globally

TNS Buyout of BT Radianz Creates One in every of the Biggest Trading Networks Globally

TNS Buyout of BT Radianz Creates One in every of the Biggest Trading Networks Globally

TNS Buyout of BT Radianz Creates One in every of the Biggest Trading Networks Globally

TNS Buyout of BT Radianz Creates One in every of the Biggest Trading Networks Globally

Monday, 02/02/2026 | 11:40 GMT

-

“The Global CFD Broker Market Will Be Disrupted by DeFi” in 5 Years, Says Ostium CEO

“The Global CFD Broker Market Will Be Disrupted by DeFi” in 5 Years, Says Ostium CEO

“The Global CFD Broker Market Will Be Disrupted by DeFi” in 5 Years, Says Ostium CEO

“The Global CFD Broker Market Will Be Disrupted by DeFi” in 5 Years, Says Ostium CEO

“The Global CFD Broker Market Will Be Disrupted by DeFi” in 5 Years, Says Ostium CEO

“The Global CFD Broker Market Will Be Disrupted by DeFi” in 5 Years, Says Ostium CEO

“The Global CFD Broker Market Will Be Disrupted by DeFi” in 5 Years, Says Ostium CEO

“The Global CFD Broker Market Will Be Disrupted by DeFi” in 5 Years, Says Ostium CEO

“The Global CFD Broker Market Will Be Disrupted by DeFi” in 5 Years, Says Ostium CEO

“The Global CFD Broker Market Will Be Disrupted by DeFi” in 5 Years, Says Ostium CEO

Sunday, 01/02/2026 | 12:05 GMT

-

XTB Shares Surge 12% on Margin Trading and 24/5 Markets

XTB Shares Surge 12% on Margin Trading and 24/5 Markets

XTB Shares Surge 12% on Margin Trading and 24/5 Markets

XTB Shares Surge 12% on Margin Trading and 24/5 Markets

XTB Shares Surge 12% on Margin Trading and 24/5 Markets

XTB Shares Surge 12% on Margin Trading and 24/5 Markets

XTB Shares Surge 12% on Margin Trading and 24/5 Markets

XTB Shares Surge 12% on Margin Trading and 24/5 Markets

XTB Shares Surge 12% on Margin Trading and 24/5 Markets

XTB Shares Surge 12% on Margin Trading and 24/5 Markets

Sunday, 01/02/2026 | 10:42 GMT

-

Most intriguing 7% of Unique XTB Buyers Pick CFDs Now, Down From 80% in 2019

Most intriguing 7% of Unique XTB Buyers Pick CFDs Now, Down From 80% in 2019

Most intriguing 7% of Unique XTB Buyers Pick CFDs Now, Down From 80% in 2019

Most intriguing 7% of Unique XTB Buyers Pick CFDs Now, Down From 80% in 2019

Most intriguing 7% of Unique XTB Buyers Pick CFDs Now, Down From 80% in 2019

Most intriguing 7% of Unique XTB Buyers Pick CFDs Now, Down From 80% in 2019

Most intriguing 7% of Unique XTB Buyers Pick CFDs Now, Down From 80% in 2019

Most intriguing 7% of Unique XTB Buyers Pick CFDs Now, Down From 80% in 2019

Most intriguing 7% of Unique XTB Buyers Pick CFDs Now, Down From 80% in 2019

Most intriguing 7% of Unique XTB Buyers Pick CFDs Now, Down From 80% in 2019

Friday, 30/01/2026 | 12:16 GMT

-

Why Bitcoin Is Falling Nowadays? BTC Impress Drops to $83K Two-Month Low

Why Bitcoin Is Falling Nowadays? BTC Impress Drops to $83K Two-Month Low

Why Bitcoin Is Falling Nowadays? BTC Impress Drops to $83K Two-Month Low

Why Bitcoin Is Falling Nowadays? BTC Impress Drops to $83K Two-Month Low

Why Bitcoin Is Falling Nowadays? BTC Impress Drops to $83K Two-Month Low

Why Bitcoin Is Falling Nowadays? BTC Impress Drops to $83K Two-Month Low

Why Bitcoin Is Falling Nowadays? BTC Impress Drops to $83K Two-Month Low

Why Bitcoin Is Falling Nowadays? BTC Impress Drops to $83K Two-Month Low

Why Bitcoin Is Falling Nowadays? BTC Impress Drops to $83K Two-Month Low

Why Bitcoin Is Falling Nowadays? BTC Impress Drops to $83K Two-Month Low

Thursday, 29/01/2026 | 19:20 GMT

-

ING Bank Securities in Poland Plans Funding Retirement Sage Push to Venture XTB Dominance

ING Bank Securities in Poland Plans Funding Retirement Sage Push to Venture XTB Dominance

ING Bank Securities in Poland Plans Funding Retirement Sage Push to Venture XTB Dominance

ING Bank Securities in Poland Plans Funding Retirement Sage Push to Venture XTB Dominance

ING Bank Securities in Poland Plans Funding Retirement Sage Push to Venture XTB Dominance

ING Bank Securities in Poland Plans Funding Retirement Sage Push to Venture XTB Dominance

ING Bank Securities in Poland Plans Funding Retirement Sage Push to Venture XTB Dominance

ING Bank Securities in Poland Plans Funding Retirement Sage Push to Venture XTB Dominance

ING Bank Securities in Poland Plans Funding Retirement Sage Push to Venture XTB Dominance

ING Bank Securities in Poland Plans Funding Retirement Sage Push to Venture XTB Dominance

Thursday, 29/01/2026 | 11:11 GMT

Retail FX

-

India Hikes Trading Tax, Will It Push Traders to ‘Unregulated’ CFDs?

India Hikes Trading Tax, Will It Push Traders to ‘Unregulated’ CFDs?

India Hikes Trading Tax, Will It Push Traders to ‘Unregulated’ CFDs?

India Hikes Trading Tax, Will It Push Traders to ‘Unregulated’ CFDs?

India Hikes Trading Tax, Will It Push Traders to ‘Unregulated’ CFDs?

India Hikes Trading Tax, Will It Push Traders to ‘Unregulated’ CFDs?

India Hikes Trading Tax, Will It Push Traders to ‘Unregulated’ CFDs?

India Hikes Trading Tax, Will It Push Traders to ‘Unregulated’ CFDs?

India Hikes Trading Tax, Will It Push Traders to ‘Unregulated’ CFDs?

India Hikes Trading Tax, Will It Push Traders to ‘Unregulated’ CFDs?

Monday, 02/02/2026 | 07:17 GMT

-

Weekly Roundup: Octa Entity to Launch Unique Dealer; XTB’s CFD Skills Fades

Weekly Roundup: Octa Entity to Launch Unique Dealer; XTB’s CFD Skills Fades

Weekly Roundup: Octa Entity to Launch Unique Dealer; XTB’s CFD Skills Fades

Weekly Roundup: Octa Entity to Launch Unique Dealer; XTB’s CFD Skills Fades

Weekly Roundup: Octa Entity to Launch Unique Dealer; XTB’s CFD Skills Fades

Weekly Roundup: Octa Entity to Launch Unique Dealer; XTB’s CFD Skills Fades

Weekly Roundup: Octa Entity to Launch Unique Dealer; XTB’s CFD Skills Fades

Weekly Roundup: Octa Entity to Launch Unique Dealer; XTB’s CFD Skills Fades

Weekly Roundup: Octa Entity to Launch Unique Dealer; XTB’s CFD Skills Fades

Weekly Roundup: Octa Entity to Launch Unique Dealer; XTB’s CFD Skills Fades

Saturday, 31/01/2026 | 04:00 GMT

-

Two Offshore Octa Entities to Exit Impress-Sharing Model, Plans Unique Dealer Launch

Two Offshore Octa Entities to Exit Impress-Sharing Model, Plans Unique Dealer Launch

Two Offshore Octa Entities to Exit Impress-Sharing Model, Plans Unique Dealer Launch

Two Offshore Octa Entities to Exit Impress-Sharing Model, Plans Unique Dealer Launch

Two Offshore Octa Entities to Exit Impress-Sharing Model, Plans Unique Dealer Launch

Two Offshore Octa Entities to Exit Impress-Sharing Model, Plans Unique Dealer Launch

Two Offshore Octa Entities to Exit Impress-Sharing Model, Plans Unique Dealer Launch

Two Offshore Octa Entities to Exit Impress-Sharing Model, Plans Unique Dealer Launch

Two Offshore Octa Entities to Exit Impress-Sharing Model, Plans Unique Dealer Launch

Two Offshore Octa Entities to Exit Impress-Sharing Model, Plans Unique Dealer Launch

Friday, 30/01/2026 | 17:49 GMT

-

With CFD Brokers Showing Ardour in Futures, NinjaTrader Extends Procure entry to for EU Retail Traders

With CFD Brokers Showing Ardour in Futures, NinjaTrader Extends Procure entry to for EU Retail Traders

With CFD Brokers Showing Ardour in Futures, NinjaTrader Extends Procure entry to for EU Retail Traders

With CFD Brokers Showing Ardour in Futures, NinjaTrader Extends Procure entry to for EU Retail Traders

With CFD Brokers Showing Ardour in Futures, NinjaTrader Extends Procure entry to for EU Retail Traders

With CFD Brokers Showing Ardour in Futures, NinjaTrader Extends Procure entry to for EU Retail Traders

With CFD Brokers Showing Ardour in Futures, NinjaTrader Extends Procure entry to for EU Retail Traders

With CFD Brokers Showing Ardour in Futures, NinjaTrader Extends Procure entry to for EU Retail Traders

With CFD Brokers Showing Ardour in Futures, NinjaTrader Extends Procure entry to for EU Retail Traders

With CFD Brokers Showing Ardour in Futures, NinjaTrader Extends Procure entry to for EU Retail Traders

Friday, 30/01/2026 | 12:22 GMT

-

IG Group Expects to Launch “a Crypto Proposition”

IG Group Expects to Launch “a Crypto Proposition”

IG Group Expects to Launch “a Crypto Proposition”

IG Group Expects to Launch “a Crypto Proposition”

IG Group Expects to Launch “a Crypto Proposition”

IG Group Expects to Launch “a Crypto Proposition”

IG Group Expects to Launch “a Crypto Proposition”

IG Group Expects to Launch “a Crypto Proposition”

IG Group Expects to Launch “a Crypto Proposition”

IG Group Expects to Launch “a Crypto Proposition”

Friday, 30/01/2026 | 07:59 GMT

-

Aussies on CMC Make investments Traded Native Stocks Six Events Extra Than US-Listed Ones

Aussies on CMC Make investments Traded Native Stocks Six Events Extra Than US-Listed Ones

Aussies on CMC Make investments Traded Native Stocks Six Events Extra Than US-Listed Ones

Aussies on CMC Make investments Traded Native Stocks Six Events Extra Than US-Listed Ones

Aussies on CMC Make investments Traded Native Stocks Six Events Extra Than US-Listed Ones

Aussies on CMC Make investments Traded Native Stocks Six Events Extra Than US-Listed Ones

Aussies on CMC Make investments Traded Native Stocks Six Events Extra Than US-Listed Ones

Aussies on CMC Make investments Traded Native Stocks Six Events Extra Than US-Listed Ones

Aussies on CMC Make investments Traded Native Stocks Six Events Extra Than US-Listed Ones

Aussies on CMC Make investments Traded Native Stocks Six Events Extra Than US-Listed Ones

Friday, 30/01/2026 | 04:57 GMT

-

India Hikes Trading Tax, Will It Push Traders to ‘Unregulated’ CFDs?

India Hikes Trading Tax, Will It Push Traders to ‘Unregulated’ CFDs?

Monday, 02/02/2026 | 07:17 GMT

-

Weekly Roundup: Octa Entity to Launch Unique Dealer; XTB’s CFD Skills Fades

Weekly Roundup: Octa Entity to Launch Unique Dealer; XTB’s CFD Skills Fades

Saturday, 31/01/2026 | 04:00 GMT

-

Two Offshore Octa Entities to Exit Impress-Sharing Model, Plans Unique Dealer Launch

Two Offshore Octa Entities to Exit Impress-Sharing Model, Plans Unique Dealer Launch

Friday, 30/01/2026 | 17:49 GMT

-

With CFD Brokers Showing Ardour in Futures, NinjaTrader Extends Procure entry to for EU Retail Traders

With CFD Brokers Showing Ardour in Futures, NinjaTrader Extends Procure entry to for EU Retail Traders

Friday, 30/01/2026 | 12:22 GMT

Featured Videos

Hannah Hill on Innovation, Branding & Award-Winning Skills | Executive Interview | AXI

Hannah Hill on Innovation, Branding & Award-Winning Skills | Executive Interview | AXI

Hannah Hill on Innovation, Branding & Award-Winning Skills | Executive Interview | AXI

Hannah Hill on Innovation, Branding & Award-Winning Skills | Executive Interview | AXI

Recorded are living at FMLS:25, this executive interview formulation Hannah Hill, Head of Impress and Sponsorship at AXI, in dialog with Finance Magnates, following AXI’s assemble for Most Modern Dealer of the Yr 2025.

On this huge-ranging discussion, Hannah shares insights on:

🔹What a hit the Finance Magnates award manner for AXI’s credibility and innovation

🔹How the beginning of AXI Choose, the capital allocation program, is redefining enterprise standards

🔹The enchancment and rollout of the AXI procuring and selling app across extra than one markets

🔹Using stamp evolution alongside technological advancements

🔹Encouraging and recognizing groups within the wait on of the scenes

🔹The feature of marketing, whisper, and social media in building product awareness

Hannah explains why standout products, strategic branding, and a spotlight on innovation are key to rising visibility and staying forward in a competitive brokerage panorama.

🏆 Award Highlight: Most Modern Dealer of the Yr 2025

👉 Subscribe to Finance Magnates for extra executive interviews, enterprise insights, and uncommon coverage from the realm’s leading financial events.

#FMLS25 #FinanceMagnates #MostInnovativeBroker #TradingTechnology #FinTech #Brokerage #ExecutiveInterview #AXI

Recorded are living at FMLS:25, this executive interview formulation Hannah Hill, Head of Impress and Sponsorship at AXI, in dialog with Finance Magnates, following AXI’s assemble for Most Modern Dealer of the Yr 2025.

On this huge-ranging discussion, Hannah shares insights on:

🔹What a hit the Finance Magnates award manner for AXI’s credibility and innovation

🔹How the beginning of AXI Choose, the capital allocation program, is redefining enterprise standards

🔹The enchancment and rollout of the AXI procuring and selling app across extra than one markets

🔹Using stamp evolution alongside technological advancements

🔹Encouraging and recognizing groups within the wait on of the scenes

🔹The feature of marketing, whisper, and social media in building product awareness

Hannah explains why standout products, strategic branding, and a spotlight on innovation are key to rising visibility and staying forward in a competitive brokerage panorama.

🏆 Award Highlight: Most Modern Dealer of the Yr 2025

👉 Subscribe to Finance Magnates for extra executive interviews, enterprise insights, and uncommon coverage from the realm’s leading financial events.

#FMLS25 #FinanceMagnates #MostInnovativeBroker #TradingTechnology #FinTech #Brokerage #ExecutiveInterview #AXI

Recorded are living at FMLS:25, this executive interview formulation Hannah Hill, Head of Impress and Sponsorship at AXI, in dialog with Finance Magnates, following AXI’s assemble for Most Modern Dealer of the Yr 2025.

On this huge-ranging discussion, Hannah shares insights on:

🔹What a hit the Finance Magnates award manner for AXI’s credibility and innovation

🔹How the beginning of AXI Choose, the capital allocation program, is redefining enterprise standards

🔹The enchancment and rollout of the AXI procuring and selling app across extra than one markets

🔹Using stamp evolution alongside technological advancements

🔹Encouraging and recognizing groups within the wait on of the scenes

🔹The feature of marketing, whisper, and social media in building product awareness

Hannah explains why standout products, strategic branding, and a spotlight on innovation are key to rising visibility and staying forward in a competitive brokerage panorama.

🏆 Award Highlight: Most Modern Dealer of the Yr 2025

👉 Subscribe to Finance Magnates for extra executive interviews, enterprise insights, and uncommon coverage from the realm’s leading financial events.

#FMLS25 #FinanceMagnates #MostInnovativeBroker #TradingTechnology #FinTech #Brokerage #ExecutiveInterview #AXI

Recorded are living at FMLS:25, this executive interview formulation Hannah Hill, Head of Impress and Sponsorship at AXI, in dialog with Finance Magnates, following AXI’s assemble for Most Modern Dealer of the Yr 2025.

On this huge-ranging discussion, Hannah shares insights on:

🔹What a hit the Finance Magnates award manner for AXI’s credibility and innovation

🔹How the beginning of AXI Choose, the capital allocation program, is redefining enterprise standards

🔹The enchancment and rollout of the AXI procuring and selling app across extra than one markets

🔹Using stamp evolution alongside technological advancements

🔹Encouraging and recognizing groups within the wait on of the scenes

🔹The feature of marketing, whisper, and social media in building product awareness

Hannah explains why standout products, strategic branding, and a spotlight on innovation are key to rising visibility and staying forward in a competitive brokerage panorama.

🏆 Award Highlight: Most Modern Dealer of the Yr 2025

👉 Subscribe to Finance Magnates for extra executive interviews, enterprise insights, and uncommon coverage from the realm’s leading financial events.

#FMLS25 #FinanceMagnates #MostInnovativeBroker #TradingTechnology #FinTech #Brokerage #ExecutiveInterview #AXI

-

Executive Interview | Dor Eligula | Co-Founder & Chief Business Officer, BridgeWise | FMLS:25

Executive Interview | Dor Eligula | Co-Founder & Chief Business Officer, BridgeWise | FMLS:25

Executive Interview | Dor Eligula | Co-Founder & Chief Business Officer, BridgeWise | FMLS:25

Executive Interview | Dor Eligula | Co-Founder & Chief Business Officer, BridgeWise | FMLS:25

Executive Interview | Dor Eligula | Co-Founder & Chief Business Officer, BridgeWise | FMLS:25

Executive Interview | Dor Eligula | Co-Founder & Chief Business Officer, BridgeWise | FMLS:25

On this session, Jonathan Glorious create Final Group speaks with Dor Eligula from Bridgewise, a immediate-rising AI-powered research and analytics company supporting brokers and exchanges worldwide.

We originate with Dor’s response to the Summit after which hasten to dealer order and the immediate wins brokers most regularly fail to observe. Dor shares where he sees “blue ocean” order across Asian markets and how native client behaviour shapes seek files from.

We also focus on the rollout of AI across funding research. Dor gives true examples of how automation and human judgment meet at Bridgewise — including moments when analysts corrected AI output, and times when AI performed with out an error.

We shut with a functional test: how retail traders can in reality expend AI with out falling into frequent traps.

On this session, Jonathan Glorious create Final Group speaks with Dor Eligula from Bridgewise, a immediate-rising AI-powered research and analytics company supporting brokers and exchanges worldwide.

We originate with Dor’s response to the Summit after which hasten to dealer order and the immediate wins brokers most regularly fail to observe. Dor shares where he sees “blue ocean” order across Asian markets and how native client behaviour shapes seek files from.

We also focus on the rollout of AI across funding research. Dor gives true examples of how automation and human judgment meet at Bridgewise — including moments when analysts corrected AI output, and times when AI performed with out an error.

We shut with a functional test: how retail traders can in reality expend AI with out falling into frequent traps.

On this session, Jonathan Glorious create Final Group speaks with Dor Eligula from Bridgewise, a immediate-rising AI-powered research and analytics company supporting brokers and exchanges worldwide.

We originate with Dor’s response to the Summit after which hasten to dealer order and the immediate wins brokers most regularly fail to observe. Dor shares where he sees “blue ocean” order across Asian markets and how native client behaviour shapes seek files from.

We also focus on the rollout of AI across funding research. Dor gives true examples of how automation and human judgment meet at Bridgewise — including moments when analysts corrected AI output, and times when AI performed with out an error.

We shut with a functional test: how retail traders can in reality expend AI with out falling into frequent traps.

On this session, Jonathan Glorious create Final Group speaks with Dor Eligula from Bridgewise, a immediate-rising AI-powered research and analytics company supporting brokers and exchanges worldwide.

We originate with Dor’s response to the Summit after which hasten to dealer order and the immediate wins brokers most regularly fail to observe. Dor shares where he sees “blue ocean” order across Asian markets and how native client behaviour shapes seek files from.

We also focus on the rollout of AI across funding research. Dor gives true examples of how automation and human judgment meet at Bridgewise — including moments when analysts corrected AI output, and times when AI performed with out an error.

We shut with a functional test: how retail traders can in reality expend AI with out falling into frequent traps.

On this session, Jonathan Glorious create Final Group speaks with Dor Eligula from Bridgewise, a immediate-rising AI-powered research and analytics company supporting brokers and exchanges worldwide.

We originate with Dor’s response to the Summit after which hasten to dealer order and the immediate wins brokers most regularly fail to observe. Dor shares where he sees “blue ocean” order across Asian markets and how native client behaviour shapes seek files from.

We also focus on the rollout of AI across funding research. Dor gives true examples of how automation and human judgment meet at Bridgewise — including moments when analysts corrected AI output, and times when AI performed with out an error.

We shut with a functional test: how retail traders can in reality expend AI with out falling into frequent traps.

On this session, Jonathan Glorious create Final Group speaks with Dor Eligula from Bridgewise, a immediate-rising AI-powered research and analytics company supporting brokers and exchanges worldwide.

We originate with Dor’s response to the Summit after which hasten to dealer order and the immediate wins brokers most regularly fail to observe. Dor shares where he sees “blue ocean” order across Asian markets and how native client behaviour shapes seek files from.

We also focus on the rollout of AI across funding research. Dor gives true examples of how automation and human judgment meet at Bridgewise — including moments when analysts corrected AI output, and times when AI performed with out an error.

We shut with a functional test: how retail traders can in reality expend AI with out falling into frequent traps.

-

Executive Interview | Brendan Callan | CEO, TRADU | FMLS:25

Executive Interview | Brendan Callan | CEO, TRADU | FMLS:25

Executive Interview | Brendan Callan | CEO, TRADU | FMLS:25

Executive Interview | Brendan Callan | CEO, TRADU | FMLS:25

Executive Interview | Brendan Callan | CEO, TRADU | FMLS:25

Executive Interview | Brendan Callan | CEO, TRADU | FMLS:25

Brendan Callan joined us sleek off the Summit’s most anticipated debate: “Is Prop Trading Only for the Business?” Brendan argued in opposition to the motion — and the target market voted him the winner.

On this interview, Brendan explains the reasoning within the wait on of his feature. He walks throughout the message he believes many corporations steer clear of: that the unusual prop procuring and selling mannequin is simply too dependent on prices, too loose on risk, and too complex for retail audiences.

We focus on why he thinks the mannequin grew immediate, why it may maybe per chance maybe well presumably also trot into walls, and what he believes is fundamental for a cleaner, extra to blame model of prop procuring and selling.

Here’s Brendan at his frankest — intriguing, grounded, and in reality sure about what adjustments are previous due.

Brendan Callan joined us sleek off the Summit’s most anticipated debate: “Is Prop Trading Only for the Business?” Brendan argued in opposition to the motion — and the target market voted him the winner.

On this interview, Brendan explains the reasoning within the wait on of his feature. He walks throughout the message he believes many corporations steer clear of: that the unusual prop procuring and selling mannequin is simply too dependent on prices, too loose on risk, and too complex for retail audiences.

We focus on why he thinks the mannequin grew immediate, why it may maybe per chance maybe well presumably also trot into walls, and what he believes is fundamental for a cleaner, extra to blame model of prop procuring and selling.

Here’s Brendan at his frankest — intriguing, grounded, and in reality sure about what adjustments are previous due.

Brendan Callan joined us sleek off the Summit’s most anticipated debate: “Is Prop Trading Only for the Business?” Brendan argued in opposition to the motion — and the target market voted him the winner.

On this interview, Brendan explains the reasoning within the wait on of his feature. He walks throughout the message he believes many corporations steer clear of: that the unusual prop procuring and selling mannequin is simply too dependent on prices, too loose on risk, and too complex for retail audiences.

We focus on why he thinks the mannequin grew immediate, why it may maybe per chance maybe well presumably also trot into walls, and what he believes is fundamental for a cleaner, extra to blame model of prop procuring and selling.

Here’s Brendan at his frankest — intriguing, grounded, and in reality sure about what adjustments are previous due.

Brendan Callan joined us sleek off the Summit’s most anticipated debate: “Is Prop Trading Only for the Business?” Brendan argued in opposition to the motion — and the target market voted him the winner.

On this interview, Brendan explains the reasoning within the wait on of his feature. He walks throughout the message he believes many corporations steer clear of: that the unusual prop procuring and selling mannequin is simply too dependent on prices, too loose on risk, and too complex for retail audiences.

We focus on why he thinks the mannequin grew immediate, why it may maybe per chance maybe well presumably also trot into walls, and what he believes is fundamental for a cleaner, extra to blame model of prop procuring and selling.

Here’s Brendan at his frankest — intriguing, grounded, and in reality sure about what adjustments are previous due.

Brendan Callan joined us sleek off the Summit’s most anticipated debate: “Is Prop Trading Only for the Business?” Brendan argued in opposition to the motion — and the target market voted him the winner.

On this interview, Brendan explains the reasoning within the wait on of his feature. He walks throughout the message he believes many corporations steer clear of: that the unusual prop procuring and selling mannequin is simply too dependent on prices, too loose on risk, and too complex for retail audiences.

We focus on why he thinks the mannequin grew immediate, why it may maybe per chance maybe well presumably also trot into walls, and what he believes is fundamental for a cleaner, extra to blame model of prop procuring and selling.

Here’s Brendan at his frankest — intriguing, grounded, and in reality sure about what adjustments are previous due.

Brendan Callan joined us sleek off the Summit’s most anticipated debate: “Is Prop Trading Only for the Business?” Brendan argued in opposition to the motion — and the target market voted him the winner.

On this interview, Brendan explains the reasoning within the wait on of his feature. He walks throughout the message he believes many corporations steer clear of: that the unusual prop procuring and selling mannequin is simply too dependent on prices, too loose on risk, and too complex for retail audiences.

We focus on why he thinks the mannequin grew immediate, why it may maybe per chance maybe well presumably also trot into walls, and what he believes is fundamental for a cleaner, extra to blame model of prop procuring and selling.

Here’s Brendan at his frankest — intriguing, grounded, and in reality sure about what adjustments are previous due.

-

Elina Pedersen on Boost, Stability & Ultra-Low Latency | Executive Interview | Your Bourse

Elina Pedersen on Boost, Stability & Ultra-Low Latency | Executive Interview | Your Bourse

Elina Pedersen on Boost, Stability & Ultra-Low Latency | Executive Interview | Your Bourse

Elina Pedersen on Boost, Stability & Ultra-Low Latency | Executive Interview | Your Bourse

Elina Pedersen on Boost, Stability & Ultra-Low Latency | Executive Interview | Your Bourse

Elina Pedersen on Boost, Stability & Ultra-Low Latency | Executive Interview | Your Bourse

Recorded are living at FMLS:25 London, this executive interview formulation Elina Pedersen, in dialog with Finance Magnates, following her company’s assemble for Most intriguing Connectivity 2025.

🔹On this huge-ranging discussion, Elina shares insights on:

🔹What a hit a Finance Magnates award manner for credibility and popularity

🔹How dealer seek files from for balance and reliability is driving immediate order

🔹The beginning of a sleek alternate server enabling versatile entrance-conclude integrations

🔹Why ultra-low latency ought to be confirmed with files, no longer buzzwords

🔹In model errors brokers create when scaling globally

🔹Instructing the enterprise through a newly launched Dealers Academy

🔹The put AI fits into procuring and selling infrastructure and where it doesn’tElina explains why resilient wait on-conclude infrastructure, deep client partnerships, and disciplined point of curiosity are predominant for brokers having a behold to scale sustainably in right this moment time’s competitive market.

🏆 Award Highlight: Most intriguing Connectivity 2025

👉 Subscribe to Finance Magnates for extra executive interviews, enterprise insights, and uncommon coverage from the realm’s leading financial events.

#FMLS25 #FinanceMagnates #BestConnectivity #TradingTechnology #UltraLowLatency #FinTech #Brokerage #ExecutiveInterview

Recorded are living at FMLS:25 London, this executive interview formulation Elina Pedersen, in dialog with Finance Magnates, following her company’s assemble for Most intriguing Connectivity 2025.

🔹On this huge-ranging discussion, Elina shares insights on:

🔹What a hit a Finance Magnates award manner for credibility and popularity

🔹How dealer seek files from for balance and reliability is driving immediate order

🔹The beginning of a sleek alternate server enabling versatile entrance-conclude integrations

🔹Why ultra-low latency ought to be confirmed with files, no longer buzzwords

🔹In model errors brokers create when scaling globally

🔹Instructing the enterprise through a newly launched Dealers Academy

🔹The put AI fits into procuring and selling infrastructure and where it doesn’tElina explains why resilient wait on-conclude infrastructure, deep client partnerships, and disciplined point of curiosity are predominant for brokers having a behold to scale sustainably in right this moment time’s competitive market.

🏆 Award Highlight: Most intriguing Connectivity 2025

👉 Subscribe to Finance Magnates for extra executive interviews, enterprise insights, and uncommon coverage from the realm’s leading financial events.

#FMLS25 #FinanceMagnates #BestConnectivity #TradingTechnology #UltraLowLatency #FinTech #Brokerage #ExecutiveInterview

Recorded are living at FMLS:25 London, this executive interview formulation Elina Pedersen, in dialog with Finance Magnates, following her company’s assemble for Most intriguing Connectivity 2025.

🔹On this huge-ranging discussion, Elina shares insights on:

🔹What a hit a Finance Magnates award manner for credibility and popularity

🔹How dealer seek files from for balance and reliability is driving immediate order

🔹The beginning of a sleek alternate server enabling versatile entrance-conclude integrations

🔹Why ultra-low latency ought to be confirmed with files, no longer buzzwords

🔹In model errors brokers create when scaling globally

🔹Instructing the enterprise through a newly launched Dealers Academy

🔹The put AI fits into procuring and selling infrastructure and where it doesn’tElina explains why resilient wait on-conclude infrastructure, deep client partnerships, and disciplined point of curiosity are predominant for brokers having a behold to scale sustainably in right this moment time’s competitive market.

🏆 Award Highlight: Most intriguing Connectivity 2025

👉 Subscribe to Finance Magnates for extra executive interviews, enterprise insights, and uncommon coverage from the realm’s leading financial events.

#FMLS25 #FinanceMagnates #BestConnectivity #TradingTechnology #UltraLowLatency #FinTech #Brokerage #ExecutiveInterview

Recorded are living at FMLS:25 London, this executive interview formulation Elina Pedersen, in dialog with Finance Magnates, following her company’s assemble for Most intriguing Connectivity 2025.

🔹On this huge-ranging discussion, Elina shares insights on:

🔹What a hit a Finance Magnates award manner for credibility and popularity

🔹How dealer seek files from for balance and reliability is driving immediate order

🔹The beginning of a sleek alternate server enabling versatile entrance-conclude integrations

🔹Why ultra-low latency ought to be confirmed with files, no longer buzzwords

🔹In model errors brokers create when scaling globally

🔹Instructing the enterprise through a newly launched Dealers Academy

🔹The put AI fits into procuring and selling infrastructure and where it doesn’tElina explains why resilient wait on-conclude infrastructure, deep client partnerships, and disciplined point of curiosity are predominant for brokers having a behold to scale sustainably in right this moment time’s competitive market.

🏆 Award Highlight: Most intriguing Connectivity 2025

👉 Subscribe to Finance Magnates for extra executive interviews, enterprise insights, and uncommon coverage from the realm’s leading financial events.

#FMLS25 #FinanceMagnates #BestConnectivity #TradingTechnology #UltraLowLatency #FinTech #Brokerage #ExecutiveInterview

Recorded are living at FMLS:25 London, this executive interview formulation Elina Pedersen, in dialog with Finance Magnates, following her company’s assemble for Most intriguing Connectivity 2025.

🔹On this huge-ranging discussion, Elina shares insights on:

🔹What a hit a Finance Magnates award manner for credibility and popularity

🔹How dealer seek files from for balance and reliability is driving immediate order

🔹The beginning of a sleek alternate server enabling versatile entrance-conclude integrations

🔹Why ultra-low latency ought to be confirmed with files, no longer buzzwords

🔹In model errors brokers create when scaling globally

🔹Instructing the enterprise through a newly launched Dealers Academy

🔹The put AI fits into procuring and selling infrastructure and where it doesn’tElina explains why resilient wait on-conclude infrastructure, deep client partnerships, and disciplined point of curiosity are predominant for brokers having a behold to scale sustainably in right this moment time’s competitive market.

🏆 Award Highlight: Most intriguing Connectivity 2025

👉 Subscribe to Finance Magnates for extra executive interviews, enterprise insights, and uncommon coverage from the realm’s leading financial events.

#FMLS25 #FinanceMagnates #BestConnectivity #TradingTechnology #UltraLowLatency #FinTech #Brokerage #ExecutiveInterview

Recorded are living at FMLS:25 London, this executive interview formulation Elina Pedersen, in dialog with Finance Magnates, following her company’s assemble for Most intriguing Connectivity 2025.

🔹On this huge-ranging discussion, Elina shares insights on:

🔹What a hit a Finance Magnates award manner for credibility and popularity

🔹How dealer seek files from for balance and reliability is driving immediate order

🔹The beginning of a sleek alternate server enabling versatile entrance-conclude integrations

🔹Why ultra-low latency ought to be confirmed with files, no longer buzzwords

🔹In model errors brokers create when scaling globally

🔹Instructing the enterprise through a newly launched Dealers Academy

🔹The put AI fits into procuring and selling infrastructure and where it doesn’tElina explains why resilient wait on-conclude infrastructure, deep client partnerships, and disciplined point of curiosity are predominant for brokers having a behold to scale sustainably in right this moment time’s competitive market.

🏆 Award Highlight: Most intriguing Connectivity 2025

👉 Subscribe to Finance Magnates for extra executive interviews, enterprise insights, and uncommon coverage from the realm’s leading financial events.

#FMLS25 #FinanceMagnates #BestConnectivity #TradingTechnology #UltraLowLatency #FinTech #Brokerage #ExecutiveInterview

-

Blueberry Dealer Review 2026: Guidelines, Platforms, Charges & Trading Stipulations | Finance Magnates

Blueberry Dealer Review 2026: Guidelines, Platforms, Charges & Trading Stipulations | Finance Magnates

Blueberry Dealer Review 2026: Guidelines, Platforms, Charges & Trading Stipulations | Finance Magnates

Blueberry Dealer Review 2026: Guidelines, Platforms, Charges & Trading Stipulations | Finance Magnates

Blueberry Dealer Review 2026: Guidelines, Platforms, Charges & Trading Stipulations | Finance Magnates

Blueberry Dealer Review 2026: Guidelines, Platforms, Charges & Trading Stipulations | Finance Magnates

On this video, we take an in-depth watch at @BlueberryMarketsForex , a international change and CFD dealer working since 2016, offering access to extra than one procuring and selling platforms, over 1,000 devices, and versatile memoir kinds for diversified procuring and selling kinds.

We smash down Blueberry’s regulatory structure, including its Australian Monetary Providers License (AFSL), as smartly as its authorisation and registrations in diversified jurisdictions. The overview also covers supported platforms equivalent to MetaTrader 4, MetaTrader 5, cTrader, TradingView, Blueberry.X, and web-primarily primarily based mostly procuring and selling.

You’ll rep out about accessible devices across international change, commodities, indices, fragment CFDs, and crypto CFDs, along with leverage choices, minimal and most alternate sizes, and how Blueberry constructions its Identical old and Raw accounts.

We also expose spreads, commissions, swap rates, swap-free memoir availability, funding and withdrawal strategies, processing times, and what traders can quiz from buyer make stronger and extra companies and products.

Locate the elephantine overview to search out out about whether Blueberry’s procuring and selling setup aligns along with your trip stage, strategy, and risk tolerance.

📣 Preserve as much as this point with maybe the most in model in finance and procuring and selling. Educate Finance Magnates for enterprise news, insights, and world match coverage.

Connect with us:

🔗 LinkedIn: /financemagnates

👍 Facebook: /financemagnates

📸 Instagram: https://www.instagram.com/financemagnates

🐦 X: https://x.com/financemagnates

🎥 TikTok: https://www.tiktok.com/mark/financemagnates

▶️ YouTube: /@financemagnates_official#Blueberry #BlueberryMarkets #BrokerReview #ForexBroker #CFDTrading #OnlineTrading #FinanceMagnates #TradingPlatforms #MarketInsights

On this video, we take an in-depth watch at @BlueberryMarketsForex , a international change and CFD dealer working since 2016, offering access to extra than one procuring and selling platforms, over 1,000 devices, and versatile memoir kinds for diversified procuring and selling kinds.

We smash down Blueberry’s regulatory structure, including its Australian Monetary Providers License (AFSL), as smartly as its authorisation and registrations in diversified jurisdictions. The overview also covers supported platforms equivalent to MetaTrader 4, MetaTrader 5, cTrader, TradingView, Blueberry.X, and web-primarily primarily based mostly procuring and selling.

You’ll rep out about accessible devices across international change, commodities, indices, fragment CFDs, and crypto CFDs, along with leverage choices, minimal and most alternate sizes, and how Blueberry constructions its Identical old and Raw accounts.

We also expose spreads, commissions, swap rates, swap-free memoir availability, funding and withdrawal strategies, processing times, and what traders can quiz from buyer make stronger and extra companies and products.

Locate the elephantine overview to search out out about whether Blueberry’s procuring and selling setup aligns along with your trip stage, strategy, and risk tolerance.

📣 Preserve as much as this point with maybe the most in model in finance and procuring and selling. Educate Finance Magnates for enterprise news, insights, and world match coverage.

Connect with us:

🔗 LinkedIn: /financemagnates

👍 Facebook: /financemagnates

📸 Instagram: https://www.instagram.com/financemagnates

🐦 X: https://x.com/financemagnates

🎥 TikTok: https://www.tiktok.com/mark/financemagnates

▶️ YouTube: /@financemagnates_official#Blueberry #BlueberryMarkets #BrokerReview #ForexBroker #CFDTrading #OnlineTrading #FinanceMagnates #TradingPlatforms #MarketInsights

On this video, we take an in-depth watch at @BlueberryMarketsForex , a international change and CFD dealer working since 2016, offering access to extra than one procuring and selling platforms, over 1,000 devices, and versatile memoir kinds for diversified procuring and selling kinds.

We smash down Blueberry’s regulatory structure, including its Australian Monetary Providers License (AFSL), as smartly as its authorisation and registrations in diversified jurisdictions. The overview also covers supported platforms equivalent to MetaTrader 4, MetaTrader 5, cTrader, TradingView, Blueberry.X, and web-primarily primarily based mostly procuring and selling.

You’ll rep out about accessible devices across international change, commodities, indices, fragment CFDs, and crypto CFDs, along with leverage choices, minimal and most alternate sizes, and how Blueberry constructions its Identical old and Raw accounts.

We also expose spreads, commissions, swap rates, swap-free memoir availability, funding and withdrawal strategies, processing times, and what traders can quiz from buyer make stronger and extra companies and products.

Locate the elephantine overview to search out out about whether Blueberry’s procuring and selling setup aligns along with your trip stage, strategy, and risk tolerance.

📣 Preserve as much as this point with maybe the most in model in finance and procuring and selling. Educate Finance Magnates for enterprise news, insights, and world match coverage.

Connect with us:

🔗 LinkedIn: /financemagnates

👍 Facebook: /financemagnates

📸 Instagram: https://www.instagram.com/financemagnates

🐦 X: https://x.com/financemagnates

🎥 TikTok: https://www.tiktok.com/mark/financemagnates

▶️ YouTube: /@financemagnates_official#Blueberry #BlueberryMarkets #BrokerReview #ForexBroker #CFDTrading #OnlineTrading #FinanceMagnates #TradingPlatforms #MarketInsights

On this video, we take an in-depth watch at @BlueberryMarketsForex , a international change and CFD dealer working since 2016, offering access to extra than one procuring and selling platforms, over 1,000 devices, and versatile memoir kinds for diversified procuring and selling kinds.

We smash down Blueberry’s regulatory structure, including its Australian Monetary Providers License (AFSL), as smartly as its authorisation and registrations in diversified jurisdictions. The overview also covers supported platforms equivalent to MetaTrader 4, MetaTrader 5, cTrader, TradingView, Blueberry.X, and web-primarily primarily based mostly procuring and selling.

You’ll rep out about accessible devices across international change, commodities, indices, fragment CFDs, and crypto CFDs, along with leverage choices, minimal and most alternate sizes, and how Blueberry constructions its Identical old and Raw accounts.

We also expose spreads, commissions, swap rates, swap-free memoir availability, funding and withdrawal strategies, processing times, and what traders can quiz from buyer make stronger and extra companies and products.

Locate the elephantine overview to search out out about whether Blueberry’s procuring and selling setup aligns along with your trip stage, strategy, and risk tolerance.

📣 Preserve as much as this point with maybe the most in model in finance and procuring and selling. Educate Finance Magnates for enterprise news, insights, and world match coverage.

Connect with us:

🔗 LinkedIn: /financemagnates

👍 Facebook: /financemagnates

📸 Instagram: https://www.instagram.com/financemagnates

🐦 X: https://x.com/financemagnates

🎥 TikTok: https://www.tiktok.com/mark/financemagnates

▶️ YouTube: /@financemagnates_official#Blueberry #BlueberryMarkets #BrokerReview #ForexBroker #CFDTrading #OnlineTrading #FinanceMagnates #TradingPlatforms #MarketInsights

On this video, we take an in-depth watch at @BlueberryMarketsForex , a international change and CFD dealer working since 2016, offering access to extra than one procuring and selling platforms, over 1,000 devices, and versatile memoir kinds for diversified procuring and selling kinds.

We smash down Blueberry’s regulatory structure, including its Australian Monetary Providers License (AFSL), as smartly as its authorisation and registrations in diversified jurisdictions. The overview also covers supported platforms equivalent to MetaTrader 4, MetaTrader 5, cTrader, TradingView, Blueberry.X, and web-primarily primarily based mostly procuring and selling.

You’ll rep out about accessible devices across international change, commodities, indices, fragment CFDs, and crypto CFDs, along with leverage choices, minimal and most alternate sizes, and how Blueberry constructions its Identical old and Raw accounts.

We also expose spreads, commissions, swap rates, swap-free memoir availability, funding and withdrawal strategies, processing times, and what traders can quiz from buyer make stronger and extra companies and products.

Locate the elephantine overview to search out out about whether Blueberry’s procuring and selling setup aligns along with your trip stage, strategy, and risk tolerance.

📣 Preserve as much as this point with maybe the most in model in finance and procuring and selling. Educate Finance Magnates for enterprise news, insights, and world match coverage.

Connect with us:

🔗 LinkedIn: /financemagnates

👍 Facebook: /financemagnates

📸 Instagram: https://www.instagram.com/financemagnates

🐦 X: https://x.com/financemagnates

🎥 TikTok: https://www.tiktok.com/mark/financemagnates

▶️ YouTube: /@financemagnates_official#Blueberry #BlueberryMarkets #BrokerReview #ForexBroker #CFDTrading #OnlineTrading #FinanceMagnates #TradingPlatforms #MarketInsights

On this video, we take an in-depth watch at @BlueberryMarketsForex , a international change and CFD dealer working since 2016, offering access to extra than one procuring and selling platforms, over 1,000 devices, and versatile memoir kinds for diversified procuring and selling kinds.

We smash down Blueberry’s regulatory structure, including its Australian Monetary Providers License (AFSL), as smartly as its authorisation and registrations in diversified jurisdictions. The overview also covers supported platforms equivalent to MetaTrader 4, MetaTrader 5, cTrader, TradingView, Blueberry.X, and web-primarily primarily based mostly procuring and selling.

You’ll rep out about accessible devices across international change, commodities, indices, fragment CFDs, and crypto CFDs, along with leverage choices, minimal and most alternate sizes, and how Blueberry constructions its Identical old and Raw accounts.

We also expose spreads, commissions, swap rates, swap-free memoir availability, funding and withdrawal strategies, processing times, and what traders can quiz from buyer make stronger and extra companies and products.

Locate the elephantine overview to search out out about whether Blueberry’s procuring and selling setup aligns along with your trip stage, strategy, and risk tolerance.

📣 Preserve as much as this point with maybe the most in model in finance and procuring and selling. Educate Finance Magnates for enterprise news, insights, and world match coverage.

Connect with us:

🔗 LinkedIn: /financemagnates

👍 Facebook: /financemagnates

📸 Instagram: https://www.instagram.com/financemagnates

🐦 X: https://x.com/financemagnates

🎥 TikTok: https://www.tiktok.com/mark/financemagnates

▶️ YouTube: /@financemagnates_official#Blueberry #BlueberryMarkets #BrokerReview #ForexBroker #CFDTrading #OnlineTrading #FinanceMagnates #TradingPlatforms #MarketInsights