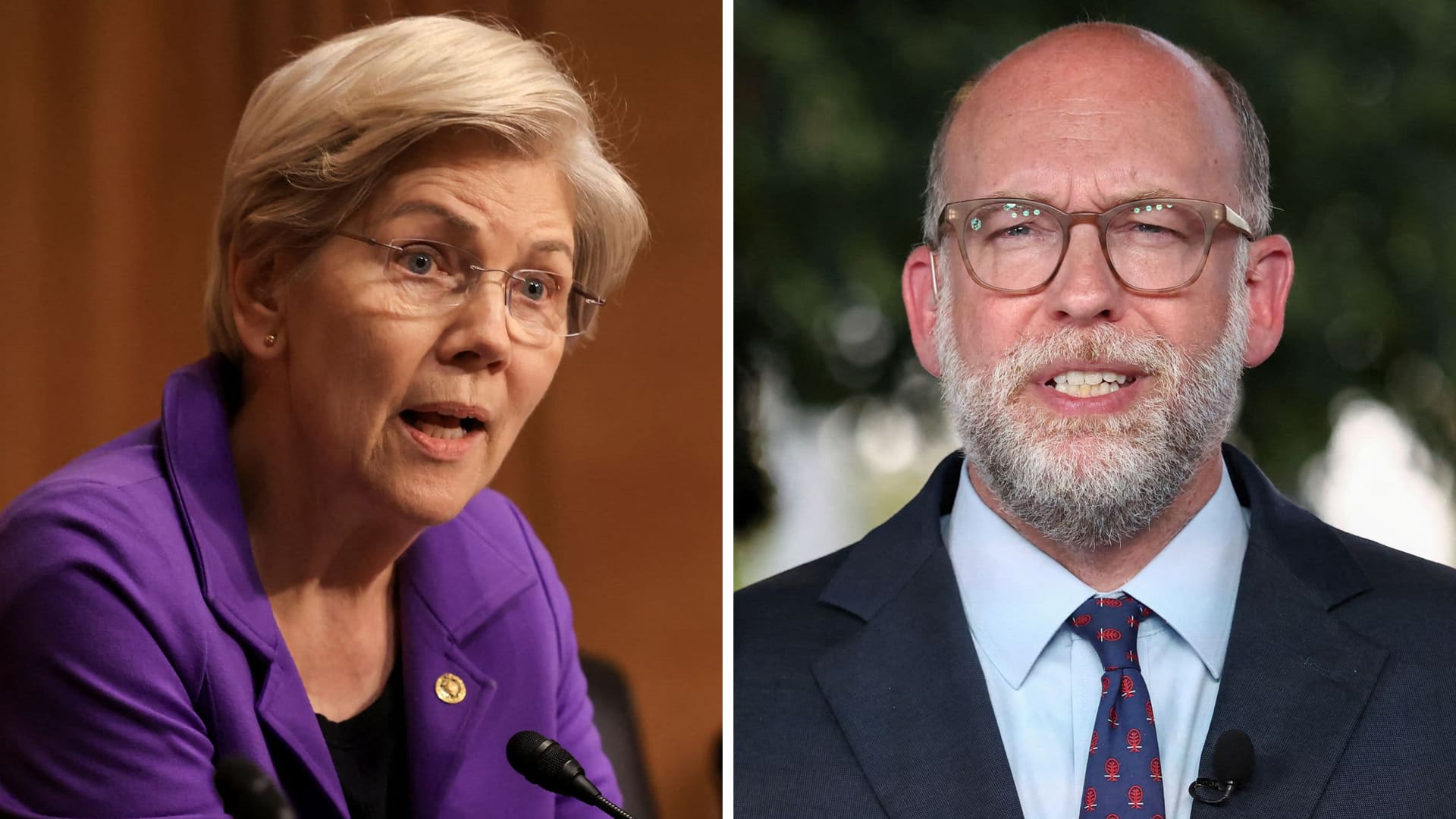

U.S. Senator Elizabeth Warren (D-MA) and Director of the United States Discipline of work of Administration and Finances, Russell Vought.

Kevin Mohatt | Kevin Lamarque | | Reuters

Sen. Elizabeth Warren on Friday accused the performing head of the Particular person Financial Security Bureau of undermining President Donald Trump‘s talked about push to form credit rating playing cards more internal your skill, according to a letter obtained completely by CNBC.

In a letter to performing CFPB Director Russell Vought, Warren, D-Mass., worthy that in the closing 365 days the agency has dropped a rule limiting bank card late prices, sided with lenders in lawsuits over incorrect practices and paused enforcement actions in opposition to the commerce.

Earlier this month, Trump demanded in a social media post that U.S. banks voluntarily cap bank card hobby charges at 10% for a 365 days. When they did not, Trump this week known as on lawmakers to circulation laws on the mission.

“I spoke with President Trump last week and told him that Congress could pass legislation to cap credit card rates, if he would fight for it,” Warren wrote in her letter to Vought.

“While Congress considers legislation to address the issue, your own actions are directly undermining the President’s stated goals,” she wrote. “Under your leadership, the CPFB has taken steps to make it easier—not harder—for big banks and credit card companies to rip off Americans.”

The letter from Warren seizes on Trump’s pivot to affordability and seeks to leverage his initiative in opposition to his have administration, escalating tensions over the monetary regulatory agency that she helped to assemble beneath the Obama administration. Contributors of the Trump administration devour sought to shutter the CFPB as fragment of a broader pro-commerce deregulatory agenda.

Latest and typical CFPB employees devour talked about the agency is on lifestyles enhance beneath Vought, who has fought in court docket to carry out mass layoffs and discontinue the agency’s funding.

An agency spokesperson talked about that the CFPB used to be disallowed from limiting bank card charges by the Dodd Frank Act.

Vought wishes to be “using the full scope of [the CFPB’s] authorities to address excessive credit card costs and to crack down on bad actors,” as a substitute of making an strive to dismantle the agency, Warren wrote.

She directed Vought to “immediately reinstate its rule capping credit card late fees at $8, which would save Americans more than $10 billion annually,” Warren talked about.

She contended Vought must also tamp down on incorrect practices across the commerce’s deferred hobby promotions, resume enforcement of principles around monitoring hobby payment increases, acknowledge to a mounting pile of client complaints, and discontinue bait-and-swap tactics with rewards programs.

“Either President Trump is not serious about making credit cards more affordable or you are insubordinately disregarding his direction,” she wrote.